By: Aissatou Touré

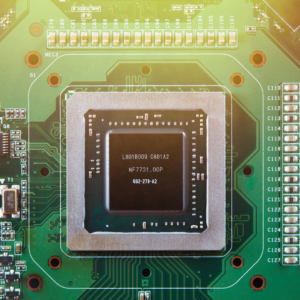

The U.S. Government Accountability Office (“GAO”) describes U.S.-China relations as tense.[1] One of the U.S.’s main trading partners is China, but the concern over China’s rapid military expansion and development has caused concern and challenges to its U.S. counterpart.[2] In August 2023, President Biden passed an executive order addressing U.S. investments in China.[3] The order specifically focuses on investments that pose a risk of transferring “intangible benefits” like expertise, talents, and access to markets when it comes to microchips and semiconductors.[4]China is one of the leading markets in technological advancements and the passing of the executive order hinders China’s ability to trade with the United States and other countries.[5] The Chinese Commerce Ministry replied to the executive order and requested that the U.S. “respect the market economy and […] fair competition” and “refrain from artificially hindering global trade [by] creating obstacles that impede […] the global economy.”[6] The Chinese Commerce Ministry believes that the U.S.’s continuously restrictive measures on Chinese technology have a detrimental effect on China and, therefore, international trade.[7]

The executive order directs the Secretary of Treasury to issue regulations that identify the areas of technology that exhibit a U.S. national security threat.[8] The Treasury Department stated that it will only implement the restriction in the order once the order takes affect in 2024.[9] This suggested framework is one of the United States’ economic strategies, aligning with its overarching national security approach concerning China and it is likely that this approach will be utilized more frequently in the future.[10]

When compared to the Donald Trump administration which introduced over $360 billion in tariffs, it is no wonder that the Chinese Commerce Ministry feels targeted.[11] Coupled with the fact that the Biden administration has discouraged allies from selling chips to China creates a concern that this may be too restrictive to the Chinese markets and could spell the end for China as a global market superpower.[12] Even if the Biden administration stresses that it is only doing this to prevent Chinese military advancement and, therefore, promote national security, the Chinese believe this to be “technology bullying.”[13] The Chinese have retaliated by putting a stop to U.S.-Chinese mergers and banning U.S. microchips.[14] This is no telling how far this back and forth will go and with continuous global tensions in Azerbaijan and Armenia and other global conflicts. This spells not just a difficult road ahead in U.S.-Chinese relations but also worldwide relations in the realm of diplomacy and trade.

[1] See generally Information on Funding for U.S.-China Research Collaboration and Other International Activities, U.S. Gov’t Accountability Off., GAO-22-105313, (2023).

[2] See Id.

[3] See Exec. Order No. 14,105, 88 Fed. Reg. at 54,867 (Aug. 9, 2023).

[4] See Noah Berman, President Biden Has Banned Some U.S. Investment in China. Here’s What to Know, Couns. On Foreign Rel. (Aug. 29, 2023, 2:40 PM), https://www.cfr.org/in-brief/president-biden-has-banned-some-us-investment-china-heres-what-know.

[5] See Clement Tan, ‘Blatant economic coercion’: China slams Biden’s order limiting U.S. overseas tech investment, CNBC (Aug. 10, 2023), https://www.cnbc.com/2023/08/10/china-slams-biden-order-limiting-us-overseas-technology-investment.html.

[6] See id.

[7] See id.

[8] See Provisions Pertaining to U.S. Investments in Certain National Security Technologies and Products in Countries of Concern, 88 Fed. Reg. 54,961 (Aug. 14, 2023).

[9] See Berman, supra note 4.

[10] See With Biden Executive Order, A U.S. Outbound Investment Control Regime Takes an Important Step Forward – Focused On China, But Significant Steps Remain Before Implementation, Gibson Dunn (Aug. 14, 2023) https://www.gibsondunn.com/with-biden-executive-order-us-outbound-investment-control-regime-takes-important-step-forward-focused-on-china/ ; see also Gibson, Dunn & Crutcher LLP, 2022 Year-End Sanctions and Export Controls Update (Feb. 7, 2023), https://www.gibsondunn.com/2022-year-end-sanctions-and-export-controls-update.

[11] See Berman, supra note 4.

[12] See id.; see also Tan, supra note 5.

[13] See Tan, supra note 5.

[14] See generally, id.