By: Eli Sulkin

“Amazon is taking over the world.” If you’re one of the millions of people who order from Amazon.com (“Amazon”) almost daily, you’ve probably uttered those words. Amazon’s rapid growth has sparked concerns that the company has grown too large.[1] For example, in an effort to attack Amazon, President Trump stated that Amazon “has a huge antitrust problem.”[2] However, the president is wrong. If the government brought such a claim, it would likely lose. To understand why, it is important to understand Amazon’s business structure.

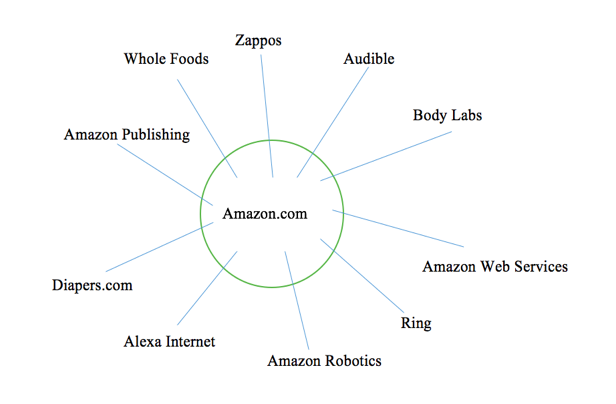

At its core, Amazon is an online marketplace that connects sellers with buyers. A seller provides Amazon with the maximum and minimum price for which it is willing to list a product.[3] Amazon then changes the price of a product throughout the day depending on the market for that product.[4] However, as Amazon grows more powerful, it continues to expand into new markets by acquiring businesses.[5] For example, in 2016, Amazon bought Whole Foods and now offers its Amazon Prime customers two-hour delivery for groceries.[6] However, while Amazon grows and enters more industries, none of the business acquisitions will likely spark antitrust violations under the modern theories of antitrust followed by the courts.

From the Great Depression to the late 1970s, the U.S. Supreme Court followed the “Harvard” theory of antitrust.[7] Under that theory, the Court focused on the market structure when deciding cases.[8] Companies with large market shares were seen as inherently anticompetitive and therefore in violation of antitrust laws.[9] The Court took the position that consumers are better off with many small and medium businesses rather than few large ones.[10] However, since the late 1970s, the Court shifted from the Harvard theory to the “Chicago” theory.[11]

Since the 1970s, the Court has followed the Chicago theory of antitrust.[12] Rather than market share, the Chicago theory focuses on consumer benefit.[13] A corporation with a significant market share does not violate antitrust law so long as the consumer benefits from that corporation’s conduct.[14] Further, the Chicago theory focuses less on prices because its proponents argue that predatory pricing is unsustainable and therefore rare.[15]

Since Amazon’s initial public offering (IPO) in 1997, it has grown from an online book retailer to an e-commerce giant.[16] As Amazon grows, questions about antitrust violations have too.[17] Although some argue that Amazon’s practices should trigger antitrust litigation, Amazon is likely safe under both modern theories.[18]

As shown in the diagram above, Amazon owns subsidiaries in various industries. [19] Amazon then sells products from those subsidiaries to consumers.[20] Neither Amazon nor its subsidiaries control enough of a particular market for the government to prevail under the Harvard theory.[21] Moreover, Amazon prices its own products at competitive but not predatory levels.[22] Theorists who subscribe to the Chicago theory likely view Amazon’s practices positively.[23] Amazon offers consumers goods at competitive prices with efficient delivery. This practice is only possible because of Amazon’s size and resources.

Under both theories of antitrust law, the government would not prevail in a claim against Amazon. While President Trump continues to express outrage at Amazon, his antitrust threats are empty. If President Trump wants to hurt Amazon, he’ll need Congress to rewrite the antitrust laws. Of course, if the president gets his way, consumers may lose.

[1] See, e.g., Kyle Feldscher, Bernie Sanders: Trump is Right, Amazon Has Gotten Too Big, Washington Examiner (Apr. 3, 2018, 10:25 AM), https://www.washingtonexaminer.com/news/bernie-sanders-trump-is-right-amazon-has-gotten-too-big.

[2] Trump Says Amazon.com Has ‘A Huge Antitrust Problem’, Reuters (May, 12, 2016, 11:05 PM), https://www.reuters.com/article/us-usa-election-trump-amazon-com/trump-says-amazon-com-has-a-huge-antitrust-problem-idUSKCN0Y4075.

[3] Amazon, https://sellercentral.amazon.com/gp/help/external/202024630?language=en-US&ref=efph_202024630_cont_202129000 (last visited Mar. 24, 2018).

[4] Amazon, https://sellercentral.amazon.com/gp/help/external/help.html?itemID=201995750& language =en-US&ref=efph_201995750_relt_201901600 (last visited Mar. 24, 2018).

[5] Christina Cheddar Berk, Amazon and Whole Foods Control Only a Sliver of the Grocery Market – For Now, Cnbc, (June 16, 2017, 12:33 PM), https://www.cnbc.com/2017/06/16/amazon-whole-foods-control-only-sliver-of-the-grocery-market-for-now.html.

[6] Amazon, https://www.amazon.com/b?ie=UTF8&node=17235386011 (last visited Mar. 24, 2018) (offering customers an Amazon Prime membership for a $99 annual fee which provides free two-day shipping, two-hour grocery delivery, and other perks).

[7] Robert D. Atkinson & David D. Audretsch, The Info. Tech. & Innovation Found., Economic Doctrines and Approaches to Antitrust 9 – 10 (2011), https://www.itif.org/files/2011-antitrust.pdf?_ga=2.71330771.1969653421.1521913643-571882700.1521913643.

[8] See, e.g., United States v. Von’s Grocery Co., 384 U.S. 270, 300 (1966) (holding a 7.5% grocery store market share in Los Angeles was too large).

[9] Id.

[10] Atkinson & Audretsch, supra note 7, at 9.

[11] Id. at 10.

[12] See, e.g., Broad. Music Inc. v. Columbia Broad. Sys., 441 U.S. 1, 19-20 (1979); Cont’l Television v. GTE Sylnia 433 U.S. 36, 56 (1977) (citing “The Antitrust Paradox” by Robert Bork in Supreme Court opinions).

[13] Atkinson & Audretsch, supra note 7, at 11.

[14] Id. at 12.

[15] Lina M. Kahn, Comment, Amazon’s Antitrust Paradox, 126 Yale L.J. 710, 742 (2017) (citing Jonathan B. Baker, Predatory Pricing After Brooke Group: An Economic Perspective, 62 Antitrust L.J. 585, 586 (1994) (arguing that the Chicago School theorists view predatory pricing as being almost always irrational, and thus unlikely to occur (citations omitted)).

[16] Tonya Garcia, 20 Years After IPO: How Amazon Came to Dominate Books, Electronics and the Cloud, Market Watch (May 21, 2017, 4:02 PM), https://www.marketwatch.com/story/how-amazon-came-to-dominate-books-electronics-and-the-cloud-2017-05-12.

[17] Id.

[18] Lina M. Kahn, Comment, Amazon’s Antitrust Paradox, 126 Yale L.J. 710, 761-68 (2017) (arguing that Amazon would likely have lost an antitrust suit regarding its pricing of ebooks had the Court followed the Harvard theory rather than the Chicago theory of antitrust).

[19] Ryan McQueeney, The Complete Guide to Everything Owned By Amazon, Zacks (June 21, 2017), https://www.zacks.com/stock/news/265126/the-complete-guide-to-everything-owned-by-amazon.

[20] Ari Levy, Amazon is Buying Products From Some US Retailers at Full Price to Build Global Inventory, Cnbc, (Jul. 21, 2017, 11:39 AM), https://www.cnbc.com/2017/07/20/amazon-new-fba-program-buys-products-from-u-s-retailers-at-full-price.html.

[21] E.g., Berk, supra note 5.

[22] Ari Shpanya, Three Ways to Optimize for Amazon’s Pricing Strategy, Econsultancy (Mar. 25, 2016), https://www.econsultancy.com/blog/67666-three-ways-to-optimize-for-amazon-s-pricing-strategy.

[23] See Kahn, supra note 16, at 719 (explaining that Chicago theorists believe an open market will determine the most efficient structure).