The D.C. Circuit Court of Appeals on February 16, 2017 set aside the October 11, 2016 ruling in PHH Corp. v. CFPB, which found the structure of the Consumer Financial Protection Bureau (“CFPB”) to be unconstitutional.[1] The Circuit Court granted the Bureau’s request to rehear that case, in which a three-judge panel of the same court also granted the White House authority to remove the CFPB’s independent Director, Richard Cordray, without cause.[2] The initial case arises from an administrative enforcement proceeding that the CFPB brought against PHH Corporation (“PHH”), a mortgage lender, for alleged violations of section 8(a) of the Real Estate Settlement Procedures Act (“RESPA”).[3] The CFPB alleged that PHH was receiving kickbacks in violation of this provision and not receiving lawful “bona fide” payments. Director Cordray upheld the Administrative Law Judge’s decision finding liability, and PHH petitioned the D.C. Circuit for review, challenging the CFPB’s constitutionality. [4]

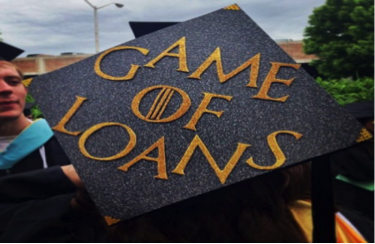

The issue addressed herein is how this re-hearing may provide relief to student loan borrowers, as the CFPB will still be able to protect borrowers from the coercive and deceptive tactics of certain student loan servicer companies.[5] For example, the CFPB has already been successful in suing for-profit college operators such as ITT Educational Services, for engaging in predatory student lending such as encouraging students to obtain high-cost private student loans.[6] This topic is important to the business community because vigilant action by the CFPB will ensure that many student loan borrowers will incur less debt, and thus be more likely to have sufficient assets and income to rent or buy real estate.[7] This re-hearing will allow the CFPB to continue its efforts to act against companies such as Navient that have illegally harmed struggling student loan borrowers, and created obstacles to repayment by providing erroneous information to borrowers.[8]

It is critical that the CFPB play an active role in preventing lenders from taking advantage of student loan borrowers, especially since these borrowers often have minimal assets and income. Indeed, these borrowers often do not have adequate financial literacy to ensure that they secure fair terms. When student loan borrowers are able to incur less punitive debt, they will be better able to live independently, an advantage to our national economy and business community.[9] In addition, more student loan borrowers will be able to secure economic mobility if they will not be taken advantage of due to their status.[10]

If additional student loan borrowers have the means to rent or purchase property, this would be beneficial for our business community, because homeownership has provided a means of wealth accumulation for owners.[11] For example, in 2013, a typical homeowner’s net worth was $195,400, while a typical renter’s net worth was $ 5,400.[12] In addition, when there are more stable economic outcomes on average, and when people are less likely to move every few years, expenditures and incomes in local communities tend to grow.[13] If there is a higher rate of home ownership, there is a higher likelihood of capital investment, which benefits the business community. Further, homeowners acquire a plethora of household goods, and often hire contractors to make improvements, generating additional income in the community.[14]

The court’s decision to re-hear this case will likely aid practitioners who seek to sue student loan servicers for their deceptive tactics. In addition, this decision gives the CFPB the ability to sue student loan servicers for violations, as the structure of the CFPB remains in place. However, this recent re-hearing decision creates some uncertainty amongst student loan borrowers, because they are unsure to the extent they will be protected against unsavory student loan servicers after the May re-hearing. Although many Republicans in Congress oppose the mission of the CFPB, the agency performs a necessary function of preventing student loan servicers from taking advantage of student loan borrowers. If the Circuit Court upholds the constitutionality of the CFPB, this will be beneficial to student loan borrowers who ultimately seek to rent or purchase housing, and thus contribute to the economic vitality of their local communities.

[1] PHH Corp. v. CFPB, No. 15-177 (D.C. Cir. 2017) (further ordering that the judgment filed October 11, 2016 be vacated, and that the oral argument before the En Banc court be heard on Wednesday May 24, 2017).

[2] PHH Corp. v. CFPB, No. 15-177 9, 10 (D.C. Cir. 2016).

[3] Roberto J. Gonzalez, Paul Weiss, Rikfkind, Wharton, & Garrison LLP, Harvard Law School Forum Corp. Governance and Financial Regulation (October 31, 2016).

[4] supra, note 3.

[5] Creating the Consumer Bureau, Consumer Finance.Gov.

[6] CFPB sues For- Profit College Chain ITT for Predatory Lending, Consumer finance.gov February 26, 2014).

[7] Jon Gorey, How student loan debt causes a chain reaction in the housing market, Boston Globe (September 30, 2016) (citing a joint report by the National Association of Realtors and the American Student Assistance organization which found that 71% of student loan borrowers who didn’t own a home cited their college loans as the main factor, while noting that incurring student debt makes it more challenging to pay for a mortgage).

[8] CFPB sues Nation’s Largest Student Loan Company Navient for Failing Borrowers at Every Stage of Repayment, Consumer Finance.Gov (January 18, 2017).

[9] Jonathan D. Glater, Student Debt and Higher Education Risk, 103 Calif. L.R. 1562, 1587-88 (2015).

[10] supra, note 8.

[11] Lawrence Yun, Why Home Ownership Matters, Forbes (August 11, 2016).

[12] supra, note 8.

[13] supra, note 8.

[14] Eduardo Penalver, Land Virtues, Cornell L.Rev. 821, 879-80 (2009).